- Canada’s GDP expected to slow in March

- US releases Core PCE Price Index

- US/CAD hits 1-month high

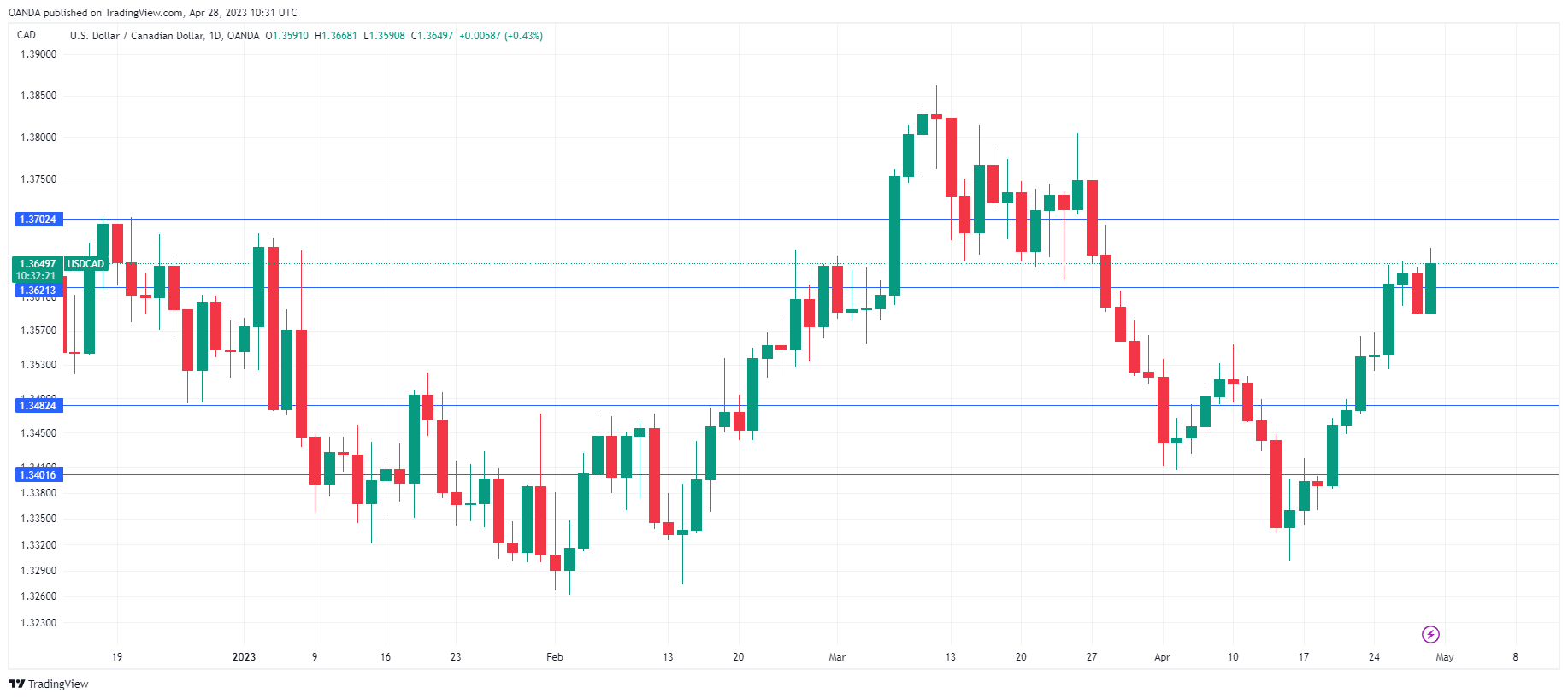

The Canadian dollar is down sharply ahead of the North American session. In Europe, USD/CAD is trading at 1.3652, up 0.45%. Earlier, USD/CAD touched a high of 1.3668, its highest level in a month.

Canada’s GDP expected to ease

Canada’s economy is expected to have expanded in February by a modest 0.2%. This would be significantly lower than the 0.5% gain in January, but first quarter is expected around 2.8% y/y, which would indicate that the economy is in good shape. The IMF is projecting that Canada’s economy will expand by 1.5% in both 2023 and 2024, which would be the second-highest rate in the G7.

A strong GDP release later today would be good news but could complicate things for the Bank of Canada, which will have to decide whether to pause for a second straight time at the next meeting in June. The BoC summary of discussions ahead of the April meeting, released on Wednesday, indicated that the BoC considered raising rates at the meeting over concerns of sticky inflation and a surprisingly strong labour market. In the end, the BoC opted to hold rates at 4.5% and monitor economic data to determine whether further rate increases are needed. The BoC has projected that inflation will drop to 3% by mid-year, but noted in the summary that it is concerned whether further tightening will be needed to reach the inflation target of 2%. This shows that the BoC is still somewhat hawkish, and with more rate hikes a possibility, rate cuts do not appear to be on the table.

In the US, we’ll get a look at the Core PCE Price Index, which is considered the Fed’s favorite inflation gauge. The markets expect the index to stay unchanged in March at 0.3% m/m, and any surprises could move the dial on the US dollar. Investors will also be keeping an eye on Personal Spending and Income, which provide a snapshot of the strength of consumer spending.

USD/CAD Technical

- USD/CAD is testing resistance at 1.3621. Next, there is resistance at 1.3702

- 1.3482 and 1.3401 are providing support

Original Post

Trading analysis offered by RobotFX and Flex EA.

Source #Unknown

Comments

Post a Comment