#

Trading analysis offered by Flex EA.

Source #Unknown

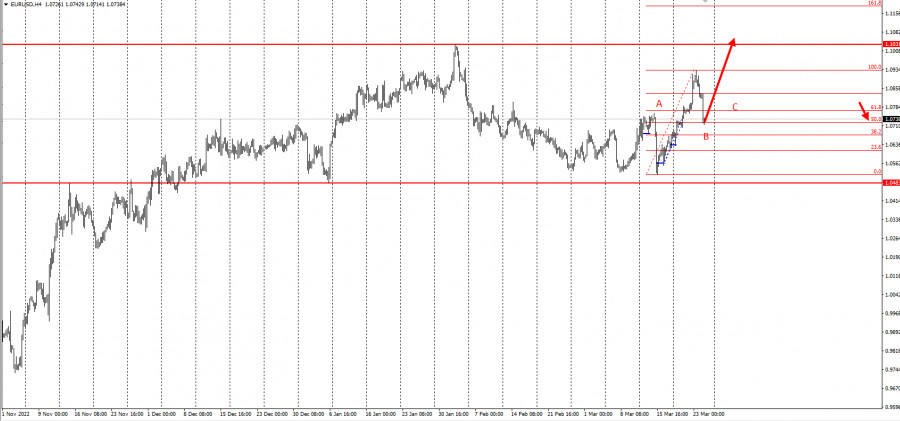

Following the release of GDP data in Spain and manufacturing activity in Germany, EUR/USD pulled back from the weekly high, opening up good price levels for long positions in the market.

At the time of writing, there is a three-wave (ABC) pattern, in which wave A represents the buying pressure from early this week. Traders should consider taking long positions from the 50% retracement level, and then exit the market by taking profit upon the breakdown of 1.10300.

This trading idea is based on the "Price Action" and "Stop hunting" methods.

Good luck and have a nice day! Don't forget to control the risks.

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment