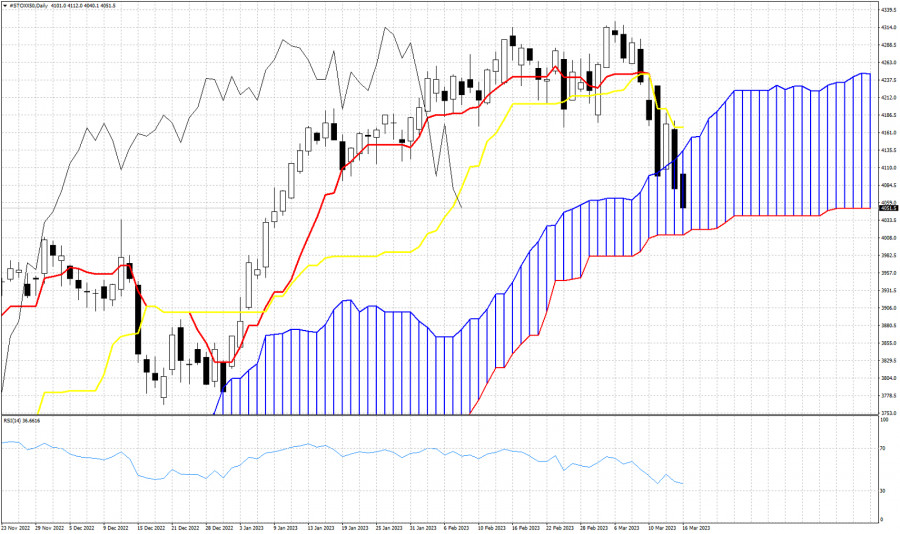

Major European indices are turning around from a multiweek bullish run to an ugly reversal. Pull backs or trend reversals to the downside are usually more aggressive and we are now witnessing such a bearish change in the major indices. Yesterday we talked extensively about DAX (German index), while today we start by taking a closer look at the EUROSTOXX50 with the help of the Ichimoku cloud indicator.

In Ichimoku cloud terms trend is now neutral as price has enter the Kumo (cloud). Price is below the negatively sloped tenkan-sen (red line indicator) and the kijun-sen (yellow line indicator). The Chikou span (black line indicator) is also now below the candlestick pattern. All the above characteristics are of a bearish trend. If these characteristics are combined with a break below the Kumo, then we will get a sell signal.

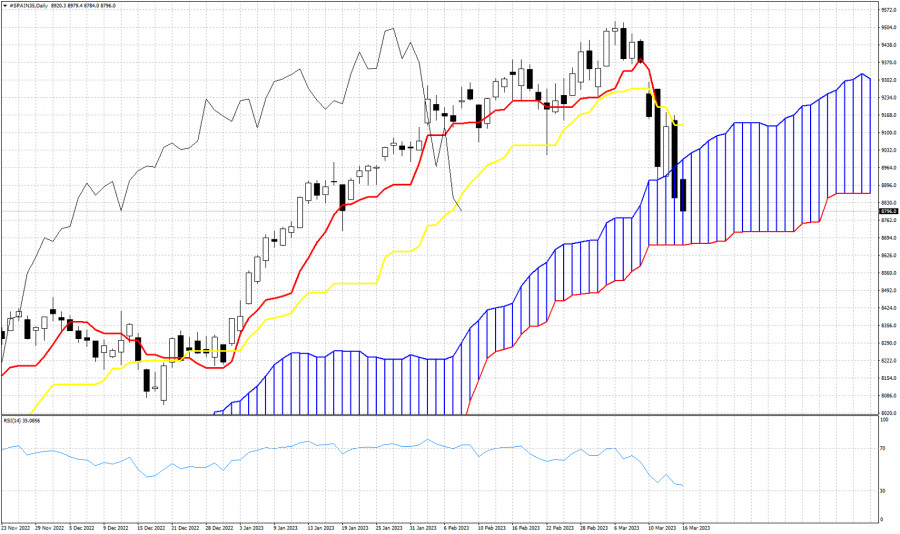

The Spanish IBEX is no different. Price is now in Neutral trend. Price is vulnerable to more downside towards the lower cloud boundary around 4,011. Recapturing the 4,170 level is important for bulls. They need to push price above this level in order to regain control.

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment