#

Trading analysis offered by Flex EA.

Source #Unknown

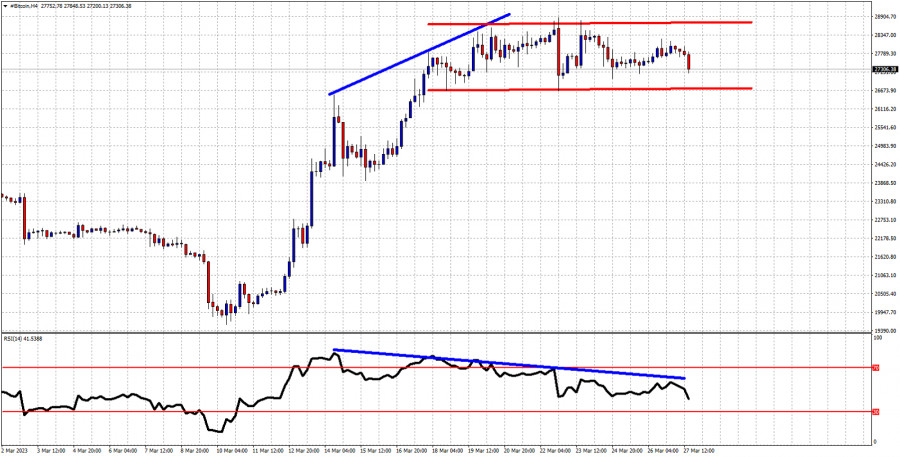

Blue lines- bearish RSI divergence

Red lines- trading range

Bitcoin is trading around $27,300. Over the last couple of sessions price has made no real progress to the upside or the downside. Price is trading mostly sideways inside a trading range. The RSI has provided us with a bearish divergence signal. Short-term support is found at the lower range boundary at $26,700. A break below the lower red range boundary will bring even more sellers and will most probably push price towards $24,500. Resistance is found at $28,880. Recapturing this level would be an important bullish sign.

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment