Pound price prediction :

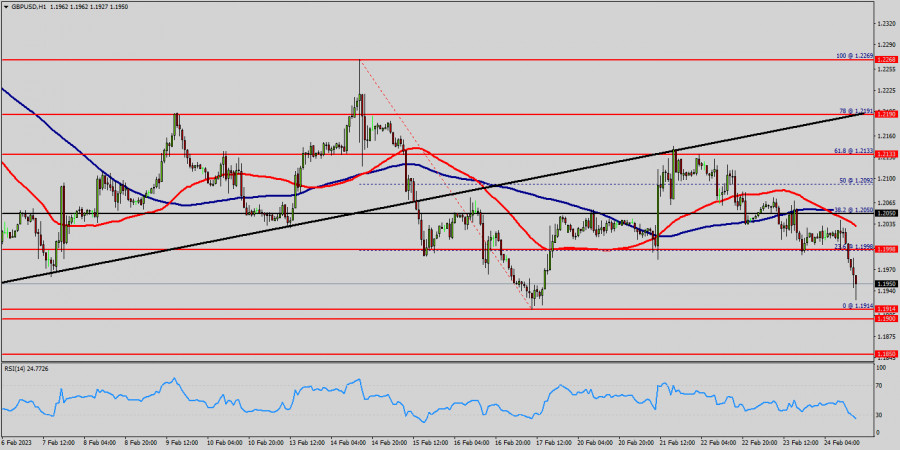

Remember that the GBP/USD pair is in donwtrend since a week! so, the GBP/USD pai is really a great fortune. Hence, our target 1.1991 in the next two days. Today, the GBP/USD pair is trading below the weekly pivot point 1.2099. Because the GBP/USD pair broke support which turned to a minor resistance at the price of 1.2099 last week in 2022.

The price of 1.2099 is expected to act as major resistance in the first week of December 2022. As long as there is no daily close below 1.2099, there are no chances of a fresh increase below 1.2099 (R1) in the H1 time frame. The support levels will be placed at the prices of 1.2099 and 1.1950. As long as there is no daily close below 1.2099, there are chances of breaking the bottom of 1.1950.

The volatility is very high for that the the GBP/USD pair is still moving between 1.2099 and 1.1950 in coming hours. As a result, the market is likely to show signs of a bullish trend again. Hence, it will be good to sell below the level of 1.2099 with the first target at 1.1950 and further to 1.1900 in order to test the weekly last bearish wave.

However, if the GBP/USD is able to break out the daily resistance at 1.2099, the market will rise further to 1.2164 to approach resistance 2 in coming days. Daily Forecast : Pivot Point : $22,462.

Forecast : According to the previous events the price is expected to remain between 1.2099 and 1.1991 levels. Sell-deals are recommended below 1.2099 with the first target seen at 1.1950.

The movement is likely to resume to the point 1.1950 and further to the point 1.1950. Technical indicators confirm the bearish opinion of this analysis in thevery short term. However, be careful of excessive bearish movements. It is appropriate to continue watching any excessive bearish movements or scanner detections which might lead to a small bullish correction.

From this point, the pair is likely to begin a descending movement to the point of 1.1991 and further to the level of 1.1950. The level of 1.1900 will act as strong support and the double bottom is already set at the point of 1.1950. This would suggest a bearish market because the RSI indicator is still in a negative area and does not show any trend-reversal signs.

The pair is expected to drop lower towards at least 1.1950 in order to test the second support (1.1900).

On the other hand, if the EUR/USD pair fails to break through the first support of 1.1950 today, the market will move upwards continuing the development of the bullish trend to the level 1.2218 (double top).

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment