Pound Sterling Fundamental Forecast: Bearish

From a fundamental point of view, the outlook for the pound remains rather bleak and this supports the fundamental bearish outlook. Consumer data improved slightly but remains constrained overall, while inflation actually showed signs of moving in the right direction, coming in better than expected on both headline and core prints. Despite better than expected prints, the pound ended the week marginally lower.

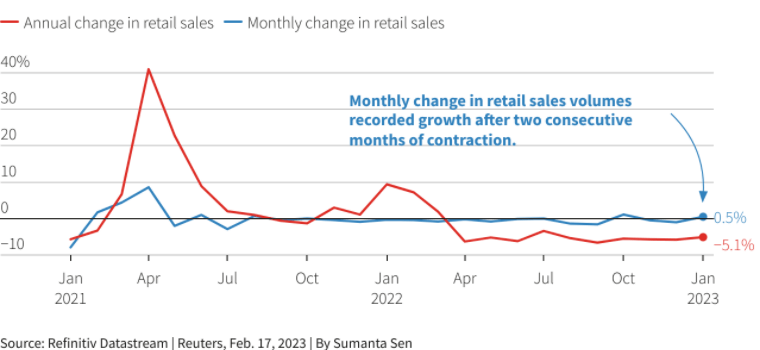

UK Retail Sales sees Slight Improvement in January but Situation Remains Glum

UK retail sales rose 0.5% from December but maintained the yearly trend of negative readings, coming in at -5.1% and marking a 10th consecutive year on year drop. The latest yearly reading marks the longest period of negative year on year declines since the Global Financial Crisis. To make matters worse, the December contraction was revised to -1.2% from -1%.

UK Retail Sales Data (Month on month in blue, and year on year in red)

EU Protocol Talks Move Forward After PM Sunak Visit

UK Prime Minister Rishi Sunak informed Northern Ireland politicians that talks re moving forward regarding easing post-Brexit rules as he looks to push for a deal with the EU. It is said that Sunak needs to win favor with the skeptical Democratic Unionist Party (DUP) if any deal is to be struck.

The DUP’s Jeffrey Donaldson mentioned that there was some real progress on some very important issues but that there are outstanding issues that need to be addressed before any deal can be concluded.

Relations are said to have undergone a drastic improvement since Sunak took over as prime minister but there is still work to be done.

Major Event Risk for the Week Ahead

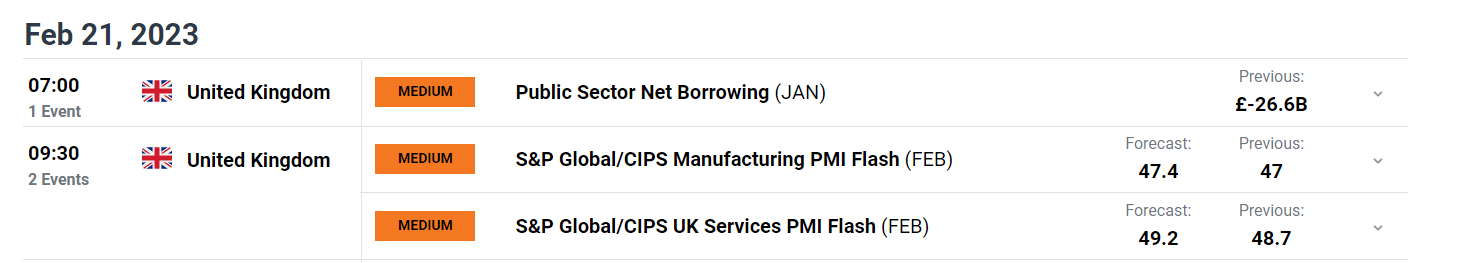

UK specific data is rather light next week apart from S&P Global manufacturing and services PMI data and public sector net borrowing - which had a definite impact on the market last month when the deficit widened considerably.

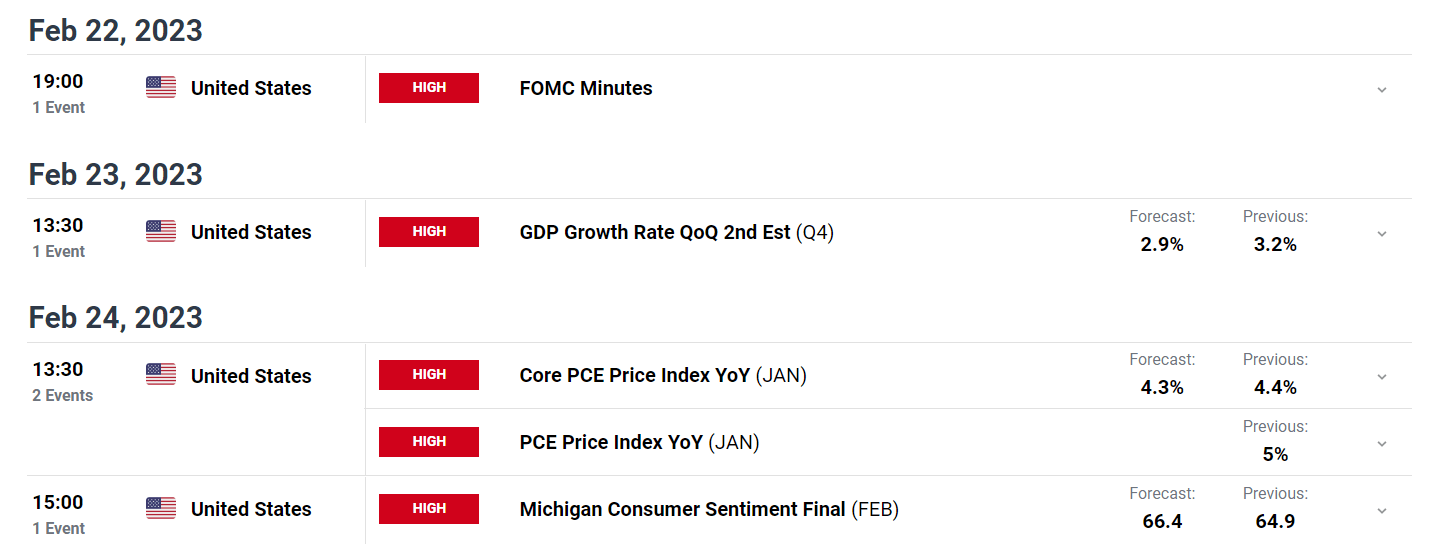

US related data remains relevant as far as it affects GBP/USD and other G7 FX. The FOMC minutes may reveal a greater preference among the committee in favor of 50 bps hikes than was initially thought. This is on the back of talk of a preferred 50 basis point hike from hawks Loretta Mester and James Bullard ahead of the March meeting although neither are voting members for 2023.

The first revision of US Q4 GDP is due next week and is unlikely to cause much commotion if the data prints inline with the flash number which typically carries the most importance. Then the final Michigan sentiment reading is announced but possibly the most notable of next weeks items is the PCE inflation data. Markets are still mainly focused on the disinflation story, particularly after CPI and PPI data revealed that inflation isn’t coming down quite as fast as hoped.

Customize and filter live economic data via our DailyFX economic calendar

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment