#

Trading analysis offered by Flex EA.

Source #Unknown

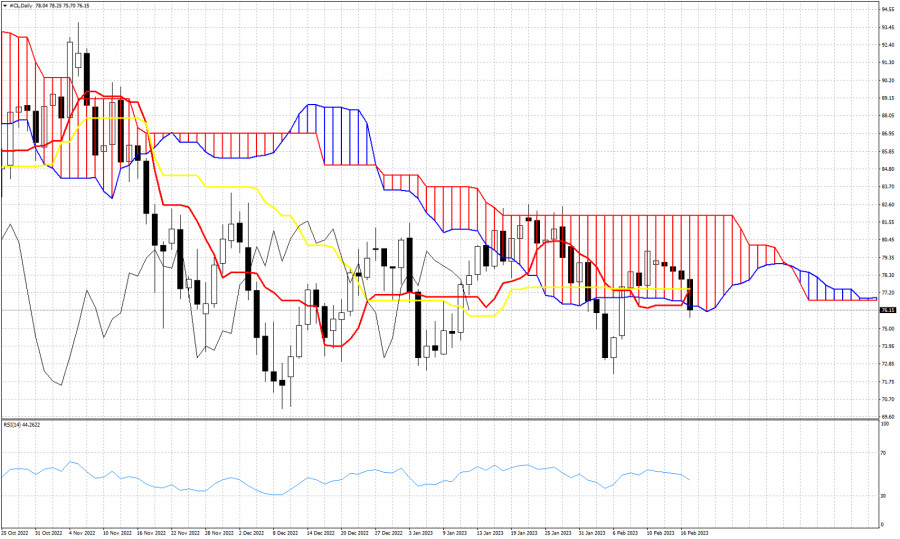

Oil price is trading around $76 and is very close to providing a new bearish signal. Price was trading inside the Kumo (cloud) for the last 8 sessions. Bulls were unable to break above the cloud resistance. Price is now trading below both the tenkan-sen (red line indicator) and the kijun-sen (yellow line indicator). The tenkan-sen and kijun-sen provide resistance is at $77.50. A daily close below the Kumo (cloud) would be a bearish sign. Bulls need to re-enter the cloud, otherwise price will remain vulnerable to more downside.

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment