#

Trading analysis offered by Flex EA.

Source #Unknown

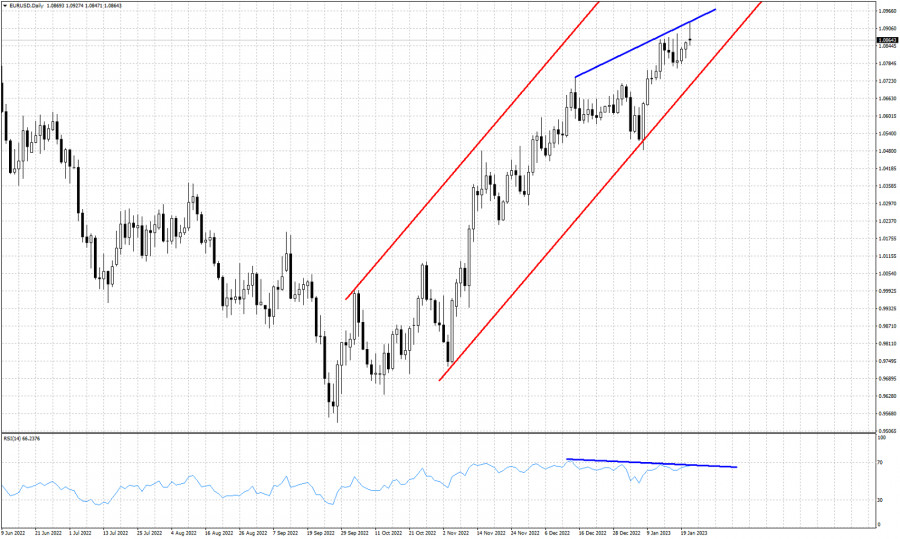

Red lines- bullish channel

Blue lines- bearish RSI divergence

EURUSD is making new multi month highs above 1.09.The week started on a positive note but as time passes, selling pressures have brought the pair back near the open prices of the week. The long upper tail in the Daily candlestick combined with the bearish RSI divergence are an important warning. Technically trend remains bullish as price is still making higher highs and higher lows inside the red upward sloping channel. Short-term support is found at 1.0767 recent low. The bearish RSI divergence is an important warning for bulls but not a reversal signal. Channel support is found at 1.0720.

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment