#

Trading analysis offered by Flex EA.

Source #Unknown

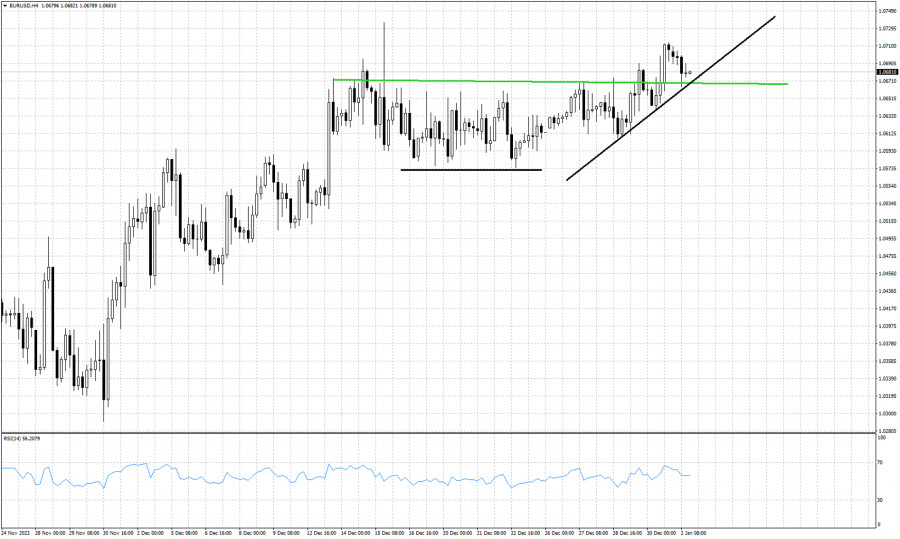

Black lines- support trend lines

Green line -resistance (broken)

EURUSD is trading around 1.0680 after breaking last week above the short-term resistance 1.0660. Price back tested the break out level and has now started making higher highs and higher lows in the 4 hour chart. Short-term support is at 1.0660 where previously resistance was. Price has the potential to continue higher as long as we stay above 1.0660-1.0650. Key support remains at 1.0570. A break below 1.0650 would be a bearish sign, but the confirmation will come with a break below 1.0570. Until then bulls are in control.

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment