#

Trading analysis offered by Flex EA.

Source #Unknown

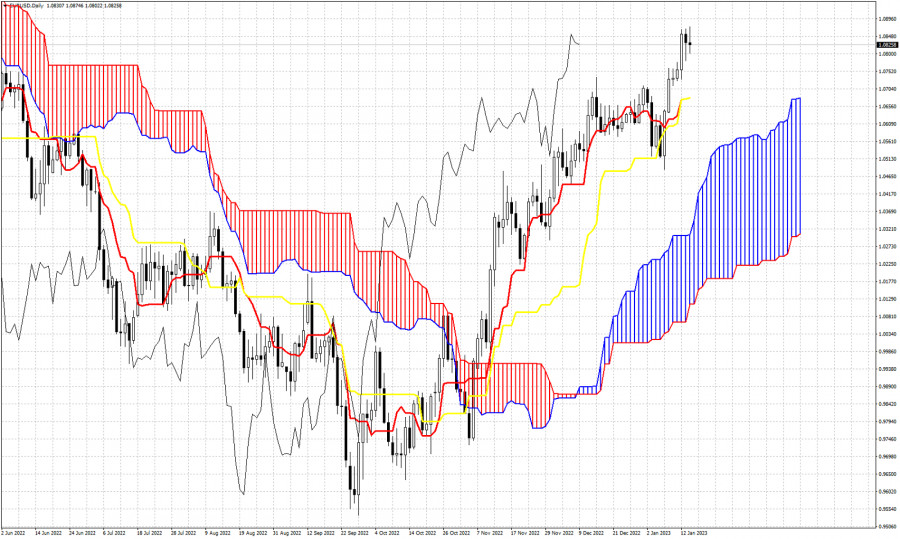

EURUSD is trading just above 1.08 as price is again under pressure following Friday's negative session. Technically trend remains bullish as price continues making higher highs and higher lows. In Ichimoku cloud terms, trend has not changed as price remains above the 4 hour Kumo (cloud). In the near term there are some overbought signs by oscillators and a pull back at least towards the tenkan-sen (red line indicator) at 1.0675 is justified. At 1.0675 we also find the kijun-sen (yellow line indicator). So this level around 1.0675 is very important support. Next support is found at the cloud at 1.0420. So far no sign of weakness.

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment