Gold rallied in the short term and now is almost to reach the first upside obstacle. It's located at 1,930 at the time of writing but it's trapped within a range pattern. Today, the fundamental factors should move the rate, so it's important to keep an eye on the economic calendar.

The US is to release a new high-impact indicator today, the Core PCE Price Index is expected by traders to increase by 0.3%, Pending Home Sales could report a 1.0% fall, while Revised UoM Consumer Sentiment could remain steady for the second month at 64.6 points.

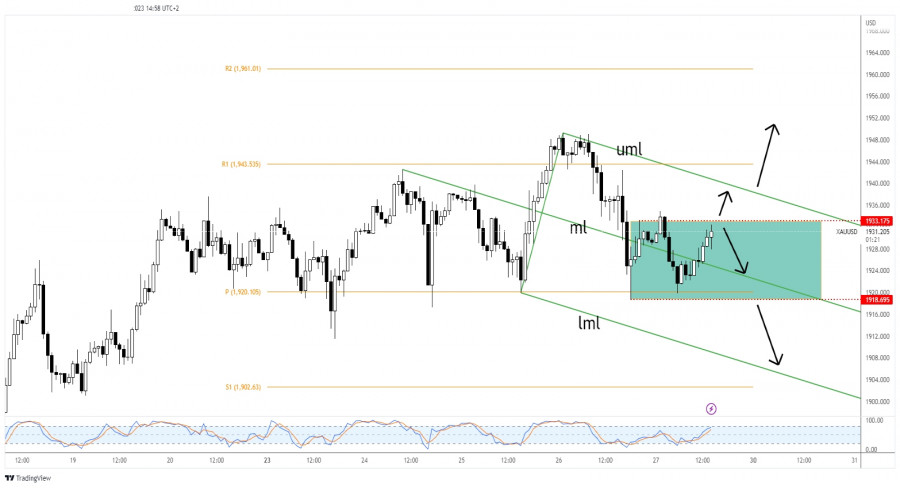

XAU/USD 1,933 As Resistance!

As you can see, XAU/USD is trapped between 1,918 and 1,933. It could move sideways if it fails to escape from this pattern. Still, personally, I believe that the US data could bring strong moves later.

It has found support on the weekly pivot point. It has printed only false breakdowns through this downside obstacle. It has also failed to stay below the median line (ml) signaling exhausted sellers.

XAU/USD Prediction!

Jumping and closing above 1,933 may signal further growth at least till the upper median line (uml). Still, only taking out this dynamic resistance may really confirm a larger growth and could bring a good long opportunity.

False breakouts through 1,933 may announce a new sell-off towards the median line (ml).

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment