#

Trading analysis offered by Flex EA.

Source #Unknown

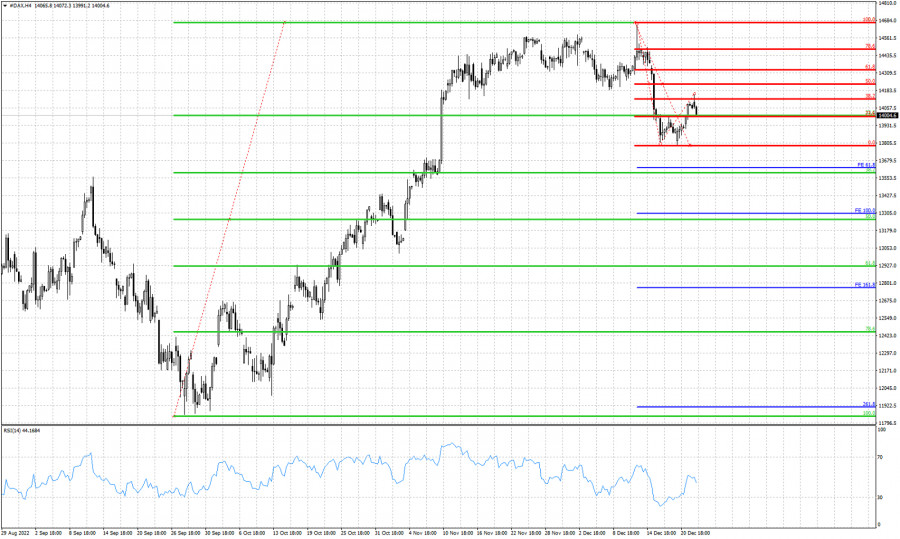

Red lines- Fibonacci retracements

Green lines- Fibonacci retracements

Blue lines- Fibonacci extension targets

DAX is under pressure. Price is now at 13,997 after getting rejected at the 38% Fibonacci retracement of the recent decline. A lower high has been formed. Support is at recent low at 13,786. A break below this low will be a bearish signal. If we get this bearish signal then our downside targets will be at 13,635-,13,600 and below that at 13,300-13,260. If bulls manage to hold above support and price breaks above 14,120, then we should expect DAX to reach the 61.8% retracement at 14,337. We believe that the most likely scenario is for price to make deeper pull back towards 13,600-13,300.

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment