#

Trading analysis offered by Flex EA.

Source #Unknown

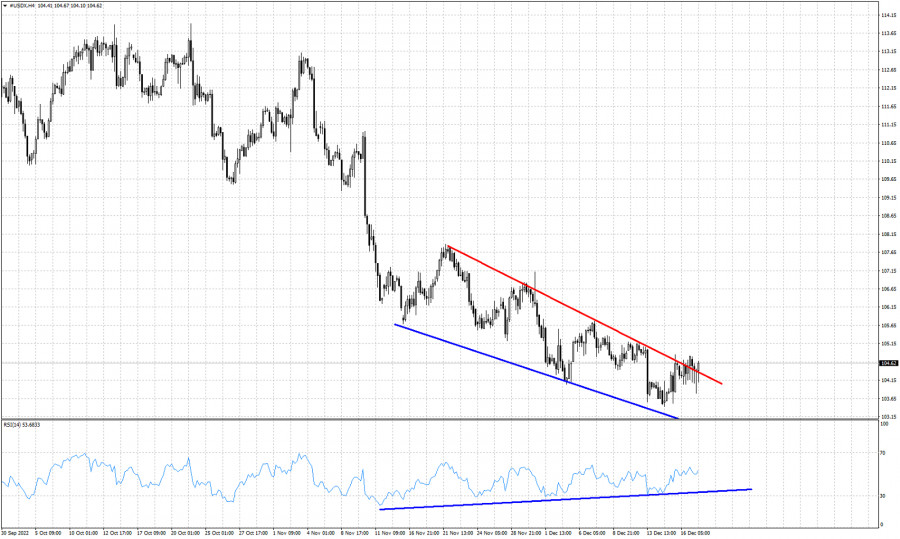

Red line -resistance (broken)

Blue line- bullish divergence

The Dollar index is trading above the upper wedge boundary. Price is showing signs of strength, signs of a reversal. Bulls need to start a sequence of higher highs and higher lows in order for this to be a confirmed reversal. As we said in previous posts, the combination of the bullish RSI divergence and the exit from the downward sloping wedge pattern is favorable to bulls. A rejection here could lead the index towards 102.70.

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment