Goldman Sachs said investors hoping for a better year in 2023 will be disappointed as the bear market phase is not over. According to strategists led by Peter Oppenheimer and Sharon Bell, conditions, which typically correspond to stock lows, have not been reached. They said peak interest rates and lower valuations reflecting the recession are needed before any sustained stock market recovery can occur.

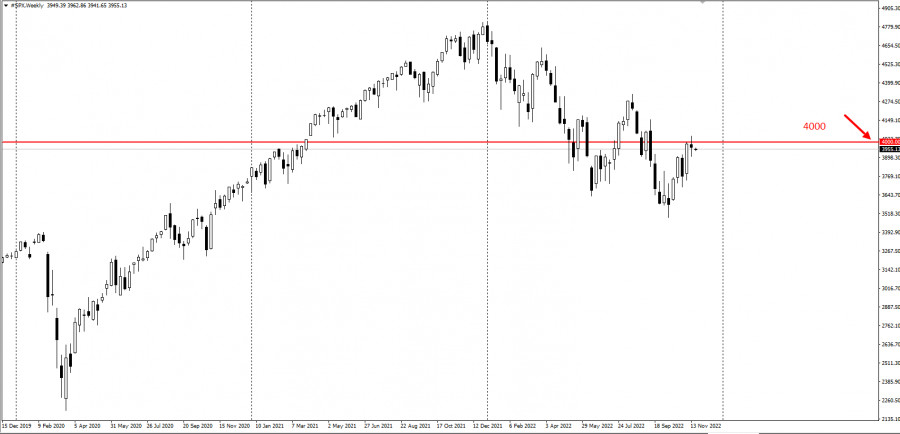

To estimate, the S&P 500 is likely to end 2023 at 4,000 index points, which is 0.9% above Friday's closing level.

Meanwhile, the Stoxx Europe 600 will finish next year about 4% higher, at 450 index points. Strategists at Barclays, led by Emmanuel Kau, said the road to get there would be "difficult."

The comments came after stocks rallied, thanks to softer inflation data in the US and news of loosening Covid restrictions in China. The sharp rebound from mid-October followed a turbulent year for global markets as central banks undertook aggressive rate hikes to tame soaring inflation, stoking fears of a recession.

Goldman strategists said growth is not sustainable because stocks typically don't recover from recessions until the pace of deteriorating economic growth and income growth slows. "The short-term trajectory of stock markets is likely to be volatile and downward," they said.

This view echoes that of Michael Wilson of Morgan Stanley, who reiterated today that US stocks will finish 2023 nearly flat from their current levels, with a significant decline in the first quarter. He said the S&P 500 would fall to 3,000 points in the first three months of next year, a 24% drawdown from Friday's close.

Still, strategists aren't all united on the fate of stocks after a volatile 2022. John Stoltzfus, chief investment strategist at Oppenheimer Asset Management, said "three double-digit rallies of the S&P 500 this year suggest that no matter how difficult 2022 is for stock markets, there is enough resilience to suggest that this year could herald better times."

Goldman strategists also expect Asian stocks to do better next year, with the MSCI AC Asia Pacific ex Japan index ending the year 11% higher at 550 points. Citigroup is also optimistic about Chinese stocks, saying Beijing's turnaround in Covid Zero and real estate should boost gains.

With the bear market still in full swing, Oppenheimer Asset Management recommended focusing on quality companies with strong balance sheets and stable margins, as well as companies with great value and energy and resource stocks where valuation risks are limited.

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment