#

Trading analysis offered by Flex EA.

Source #Unknown

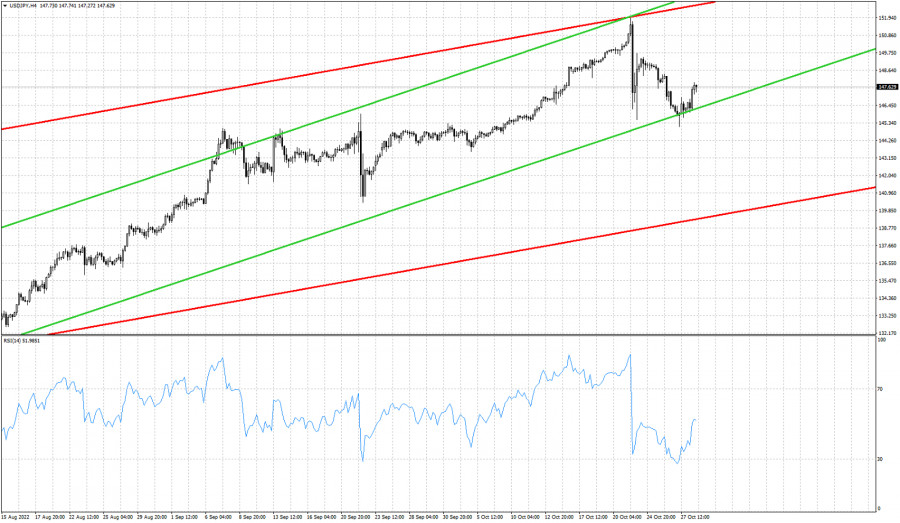

Red lines- medium-term bullish channel

Green lines- short-term bullish channel

Despite recent selling pressures on USDJPY, price is respecting the short-term channel boundary at 145.90. As we mentioned in previous posts, we are now at a crucial junction that can decide whether we continue another 500 pips lower or we resume the up trend. USDJPY has tested support at 145.90 and so far bulls have managed to defend it. Price is bouncing off the lower channel boundary. As long as price is above 145.90 we expect USDJPY to form new highs towards 152. A break below 145.90 would be a sign of weakness and a confirmation that a bigger pull back towards 140 has started.

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment