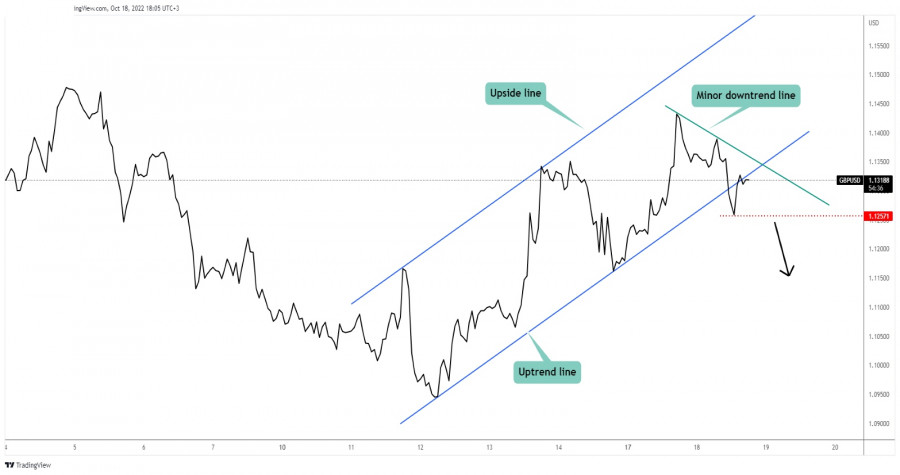

GBP/USD New Downtrend Line!

The GBP/USD pair increased within an up-channel pattern. The uptrend line represented a downside obstacle. Now, you can see that the rate dropped below it and the currency pair is trying to retest it. Dropping below this line signaled that the upside movement could be over and that the sellers could take the lead.

The 1.1257 today's low represents a static downside obstacle. Personally, I've drawn a minor downtrend line which stands as an upside obstacle. As long as it stays below it, the GBP/USD pair could drop deeper.

GBP/USD Trading Conclusion!

Staying below the minor downtrend line and dropping below 1.1257 activates more declines and brings new selling opportunities.

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment