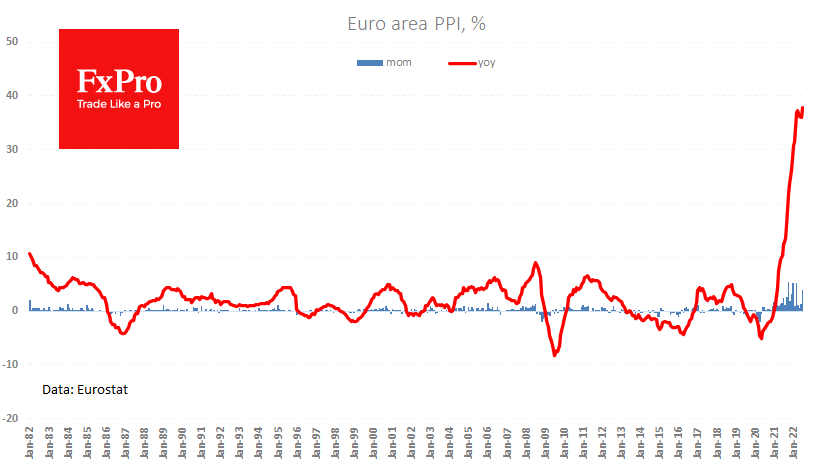

Another euro zone's inflation report is noticeably above analysts' expectations. Eurozone data published on Friday afternoon showed producer price growth of 4% for July and 37.9% year-on-year. At the same time, analysts had expected a 2.5% m/m increase and a slowdown in the annual inflation rate to 35.8%.

The fresh data set a new historical record, shattering the hopes we saw for the peak growth rate two months ago.

Producer prices are a step ahead of consumer inflation, so it is unlikely that the pressure on final consumer prices will diminish in the coming months.

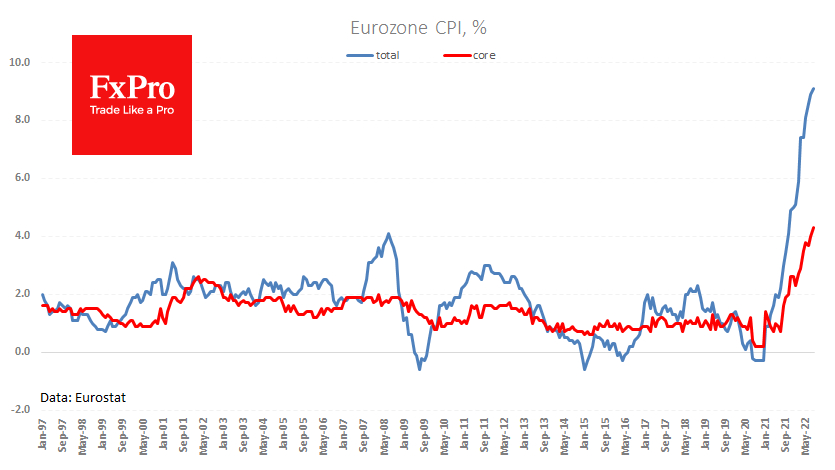

Preliminary CPI estimates published for August confirm that the inflation spiral continues to unravel. Prices are, on average, 9.1% higher than in the same month a year earlier, almost half of which is due to a jump in energy prices.

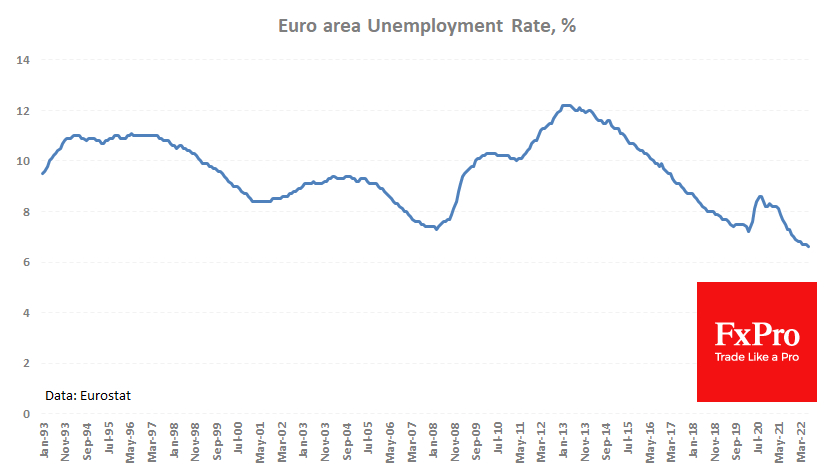

But there are two additional worrying factors. The first is the acceleration in core inflation to 4.3% y/y, indicating a breadth of inflationary pressures. The second is the drop in the unemployment rate to 6.6% (a historic low since at least 1994), which makes the price spiral even more dangerous.

The combination of low unemployment, rising prices, and a falling euro are sure companions of stagflation. In such an environment, it is not surprising that the ECB is becoming increasingly hawkish, convincing markets of its willingness to raise the rate by 75 points next week. This tightening of rhetoric has halted the sell-off in the euro.

Even if the ECB achieves the same acceleration as the Fed with a 75-point rate hike next week, there would still be a considerable lag in terms of nominal rate levels and balance sheet dynamics. The Fed has to double the pace of asset sales from the balance sheet to 90 billion a month from September, while the ECB is not even considering such an option.

On the fundamental analysis side, Fed policy and macroeconomic factors lean towards the current EUR/USD stabilization at parity, being a temporary halt but not base support. The acceleration in ECB policy normalization is making the euro fall more slowly, but not enough for a trend reversal.

Trading analysis offered by Flex EA.

Source #RobotFX Team

Comments

Post a Comment