#

Trading analysis offered by Flex EA.

Source #Unknown

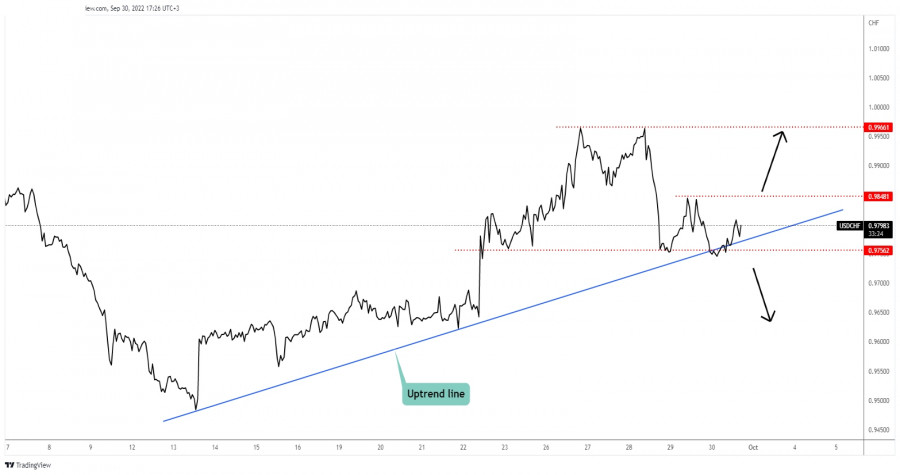

USD/CHF Upside Continuation Possible!

As you can see on the H1 chart, the rate dropped and it has challenged the uptrend line which represents a downside obstacle. The rate dropped below this line but failed to stabilize below it signaling only a false breakdown.

You knew from my previous analysis that the rate could come back to test and retest the uptrend line. As long as it stays above this level, it could resume its growth.

USD/CHF Trading Conclusion!

Jumping above 0.9848 may signal further growth towards the 0.9966 higher high.

Dropping below the uptrend line and under 0.9743 today's low activates a downside movement.

Trading analysis offered by Flex EA.

Source #Unknown

Comments

Post a Comment