Now we realize how little we understand inflation. This is how Jerome Powell argued in the Portuguese Sintra, admitting the mistake of the end of 2021. Then the Fed insisted that high prices were temporary. The time has come for Jackson Hole, and the American central bank can no longer afford to be wrong. It must throw all its strength into the fight against inflation, which puts the EURUSD bulls in a hopeless position.

Markets are growing on expectations, and no one cares about what happened in the past. Yes, the United States faced a technical recession in the first half of the year, but the quotes of the main currency pair are based on expectations of a recession in the eurozone economy. According to UBS, it is already there. The bank forecasts a 0.1% contraction in the currency bloc's GDP in the third and 0.2% in the fourth quarter. It lowered the estimate of gross domestic product growth for 2023 from 1.2% to 0.8%. These projections are based on the assumption that gas prices will continue to rise, but there will be no major shortages. If Germany and other countries move towards rationing, the recession will be much deeper.

UBS Eurozone GDP Forecasts

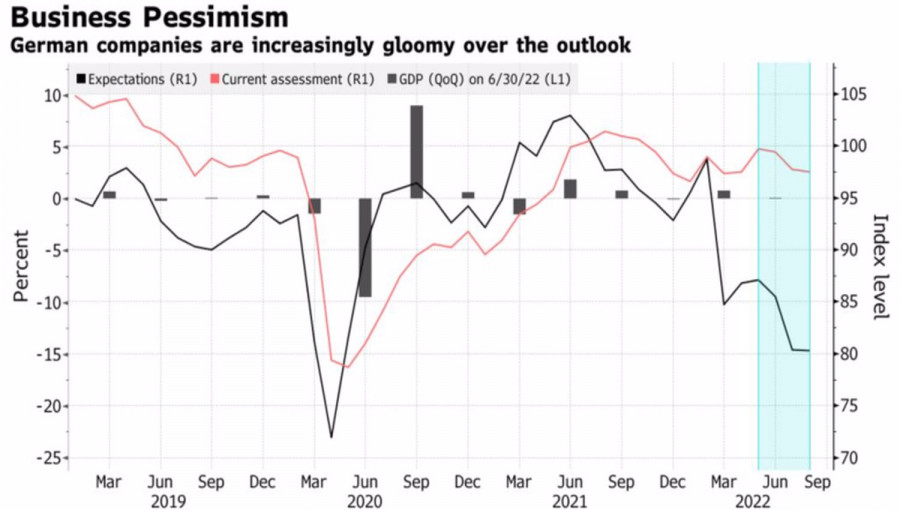

The fact that not everything is in order in the leading economy of the eurozone is also evidenced by the drop in business expectations from the German IFO institute from 80.4 in July to 80.3 in August. Moreover, the fact that the indicator turned out to be better than the forecasts of Bloomberg experts, and Germany's GDP in the second quarter grew by 0.1% with the initial reading of zero expansion, inspired the EURUSD bulls to counterattack. Music did not play for them for long, the main currency pair could not gain a foothold above parity. It was hard to imagine a different outcome on the eve of Jackson Hole.

Dynamics of the business climate and GDP in Germany

There is a lot at stake. If not all. Obviously, Jerome Powell will continue to talk about the need to fight inflation, but will he talk about the possibility of going too far—overdoing it with tightening monetary policy? If yes, investors may take this as a "dovish" surprise, pushing up not only US stock indices but also EURUSD.

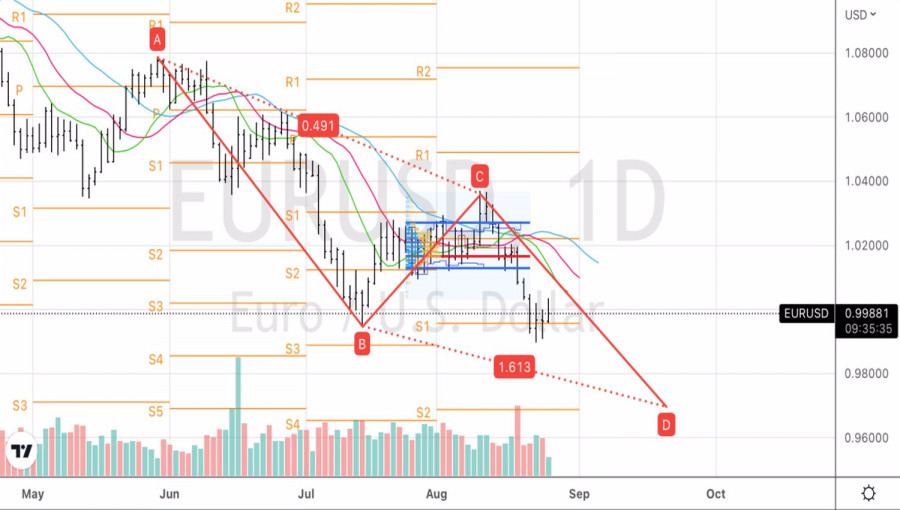

Is the euro capable of a full-fledged correction? At first glance, no, because the downward trend in the main currency pair is based on such powerful drivers as the discrepancies in the economic growth of the US and the eurozone and in the monetary policy of the Fed and the ECB. However, more than 12% subsidence of the euro against the US dollar since the beginning of the year suggests that many negative factors are already in price. All you need is a signal to take profits on shorts and pull back.

Technically, there is a risk of a pin bar forming on the EURUSD daily chart. If this is the case, traders will have an opportunity to enter a short position on a break of its low near the pivot level at 0.995. The further plan assumes building up shorts in case of storming the local minimum at 0.9895. The level of 0.97 acts as a target for the downward movement.

Trading analysis offered by Flex EA.

Source #RobotFX Team

Comments

Post a Comment