Overview :

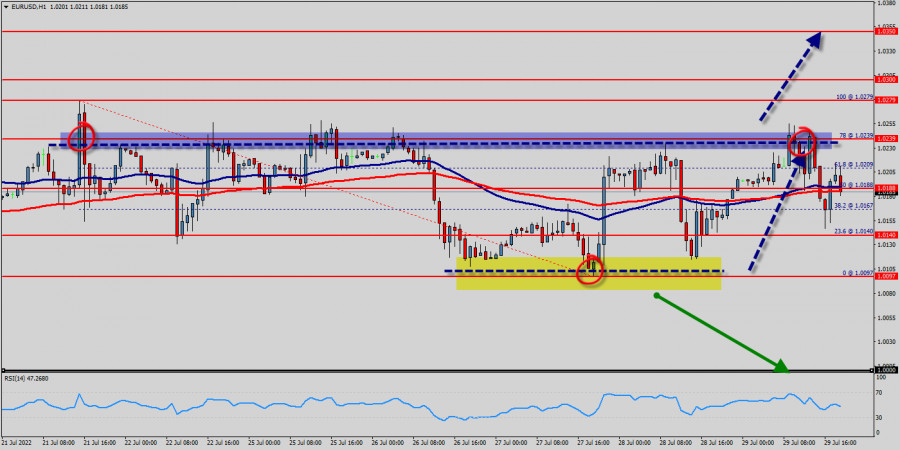

Pivot : 1.0188.

The Euro strengthened to around the daily pivot point of 1.0188, slightly above the key 1.0100 parity mark after flash reports on growth and inflation topped analysts' estimates reinforcement the case for bigger and faster ECB interest rate hikes - be careful in it and we never advise to trade it at anytime.

The EUR/USD pair traded with strong positivity yesterday to test the most important support at the area of 1.0100/1.0097, and bounced bullishly from there to test 1.0188 level now and attempts to breach it, which encourages us to continue suggesting the bullish trend for the upcoming period.

Furthermore, the price has been set above the strong support at the level of 1.0188, which coincides with the 50% Fibonacci retracement level. This resistance has been rejected several times confirming the downtrend.

The price needs to step above the last level to confirm the continuation of the bullish bias towards 1.0239 followed by 1.0279 levels as next main targets.

In the short term, there could be an acceleration of the basic bullish trend on the EUR/USD pair.

This is a positive signal for buyers. As long as the price remains above the price of 1.0097, a purchase could be considered.

Therefore, there is a possibility that the EUR/USD pair will move upside and the structure of a raise it does not look corrective.

The trend is still above the 100 EMA for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside.

The first bullish objective is located at 1.0239. The bullish momentum would be boosted by a break in this resistance.

Buyers would then use the next resistance located at 1.0279 as an objective on the hourly chart.

Since the trend is below the price of 1.0097, the market is still in an uptrend. Overall, we still prefer the bullish scenario.

On the other hand, if the EUR/USD pair fails to break out through the resistance level of 1.0239; the market will decline further to the level of 1.0140 (daily support 2).

Trading analysis offered by RobotFX and Flex EA.

Source #RobotFX Team

Comments

Post a Comment