#

Trading analysis offered by RobotFX and Flex EA.

Source #RobotFX Team

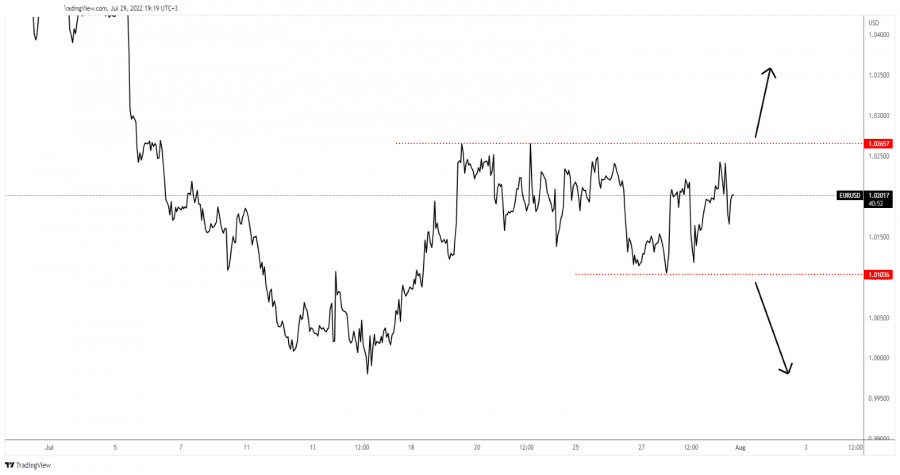

EUR/USD Range Pattern!

The EUR/USD pair was trading at 1.0195 at the time of writing. As you can see on the H1 chart, the price continues to move sideways. It is trapped between the 1.0103 and 1.0265 levels. Personally, I'm expecting the currency pair to extend its sideways movement. Only escaping from this range could bring new trading opportunities.

Technically, 1.0265 stands as an upside obstacle while 1.0103 represents a downside obstacle.

EUR/USD Trading Conclusion!

Jumping and stabilizing above the upside obstacle could bring new buying opportunities as the rate could resume its growth while breaking below 1.0105 could announce more declines.

Trading analysis offered by RobotFX and Flex EA.

Source #RobotFX Team

Comments

Post a Comment