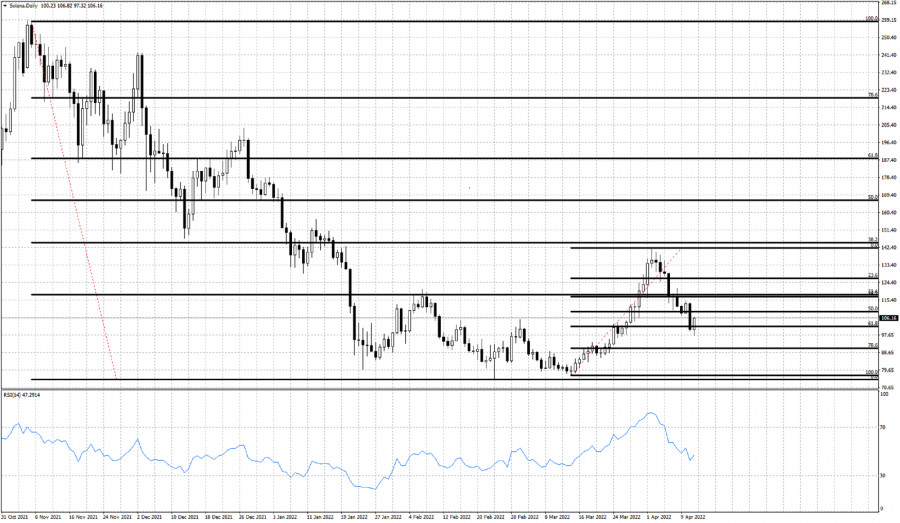

Solana has made a low around $97.32 and is now bouncing higher. Price is now at $107 and Solana seems to have formed a higher low at a key Fibonacci retracement level. In our last analysis when Solana price was challenging horizontal support at $116-$117, we warned traders that a break below that horizontal support would lead price towards $98.

Black lines- Fibonacci retracements

Solana has reached our second pull back target. Price has retraced 61.8% of the upward move from 476 to $142. Price has made a higher low and bulls must now defend it. If the higher low is not violated downwards, we should expect Solana to challenge the recent highs at $142-$143. Breaking above this level will push Solana price towards the 61.8% retracement of the entire decline at $187.

Trading analysis offered by RobotFX and Flex EA.

Source #RobotFX Team

Comments

Post a Comment