According to data released on Tuesday by the Office for National Statistics (ONS), UK unemployment in December-February fell from 3.9% to 3.8%. This is the lowest value since December 2019. Thus, the unemployment rate for the three months from December to February fell below the pre-crisis level, indicating a continuing shortage in the labor market, and employment continued to grow (35,000 new jobs were created in March, and their total number increased to 29.6 million).

The number of vacancies in January-March reached a new record of 1.288 million, and the average weekly earnings for December-February (excluding bonuses) rose by 4.0% after rising by 3.8% in the previous three-month period.

Demand for workers remains strong even as economic activity is under pressure from higher inflation and the situation in Ukraine.

Despite these seemingly brilliant data, market participants trading the pound reacted negatively to them: the pound declined, and the FTSE 100 index of the London Stock Exchange dropped 0.9% to 7,550 points.

Economists believe that real wage growth is already 1% behind inflation, which leads to a decrease in the quality of life, and, given the increasing inflation, the problem will only worsen.

Following the results of the March meeting, the Bank of England decided to raise the base interest rate to 0.75% from 0.5%, for the third time in a row since December and since the beginning of the coronavirus pandemic. This decision was made by an absolute majority of the members of the Monetary Policy Committee against the background of persistently high inflation. According to official statistics published in the month preceding this decision (February), consumer prices in the UK jumped by 5.5% in January 2022 (in annual terms), which was the highest value since March 1992.

The consumer price index (CPI) in the UK is expected to rise by another +0.7% (+6.7% in annual terms), inflation data for March will be published tomorrow at 06:00 GMT. Thus, the actions of the Bank of England lag behind accelerating inflation. At the same time, the bank itself believes that inflation will continue to accelerate in the coming months, reaching about 8% in the second quarter of 2022, and is likely to rise even higher later this year.

The UK GDP data published yesterday and the country's industrial production data, which turned out to be significantly worse than forecasts, also have a negative impact on the pound quotes. These data reflected a slowdown in UK GDP growth from 0.8% in January to 0.1% in February (the forecast assumed a slowdown to 0.3%), while the pace of industrial production recorded a slowdown in February by -0.6% (significantly worse than analysts' forecasts of growth by +0.4%). In annual terms, the pace of production slowed from 3.0% in the previous month to 1.6%.

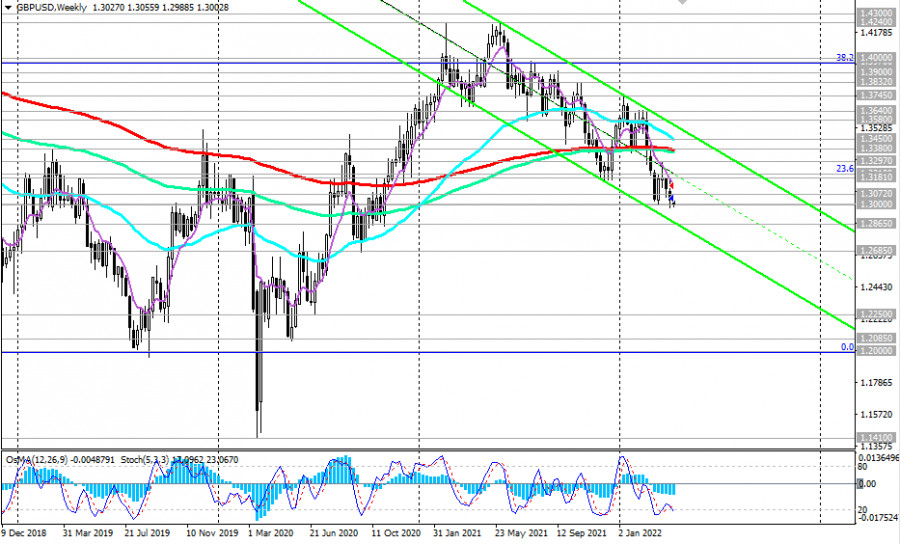

The pound remains under pressure against the USD, also declining today in major cross pairs. At the time of writing, the GBP/USD pair is trading near the 1.3000 mark, also remaining under pressure from the strengthening dollar.

Unlike the Bank of England, the Fed is taking a tougher stance on rising inflation.

Minutes released last week from the Fed's March meeting confirmed the inclination of US central bank officials to take more decisive action on monetary policy. Market participants already expect the Fed to raise the rate by 50 basis points at once in May, as well as the launch of a quantitative tightening program amounting to $95 billion per month.

The dollar is also supported by the comments of the Fed leaders. For example, Fed Board member Lael Brainard said recently that the Central Bank may need more than one rate hike of 0.50% at once during 2022.

Today, market participants will study the report of the US Bureau of Labor Statistics with data on consumer inflation (its publication is scheduled for 12:30 GMT). It is expected that the consumer price index (CPI) in the US in March rose by +1.2% (+8.4% in annual terms). This is likely to support the opinion of the Fed leaders about the need for an aggressive increase in interest rates and support the dollar.

At the time of writing, the dollar index (DXY) is near 100.11. If the inflation data is confirmed, the DXY could soon rise above 101.00, economists say, matching the highs since May 2020.

In this case, we should expect a further decline in the GBP/USD. A break of the support level of 1.3000 will open the way for the pair towards the lower border of the descending channel on the weekly GBP/USD chart, passing through the level of 1.2865. Trading below the key resistance levels 1.4580, 1.3380, and 1.3450 will keep the pair in the long-term bear market zone.

Trading analysis offered by RobotFX and Flex EA.

Source #RobotFX Team

Comments

Post a Comment