#

Trading analysis offered by RobotFX and Flex EA.

Source #RobotFX Team

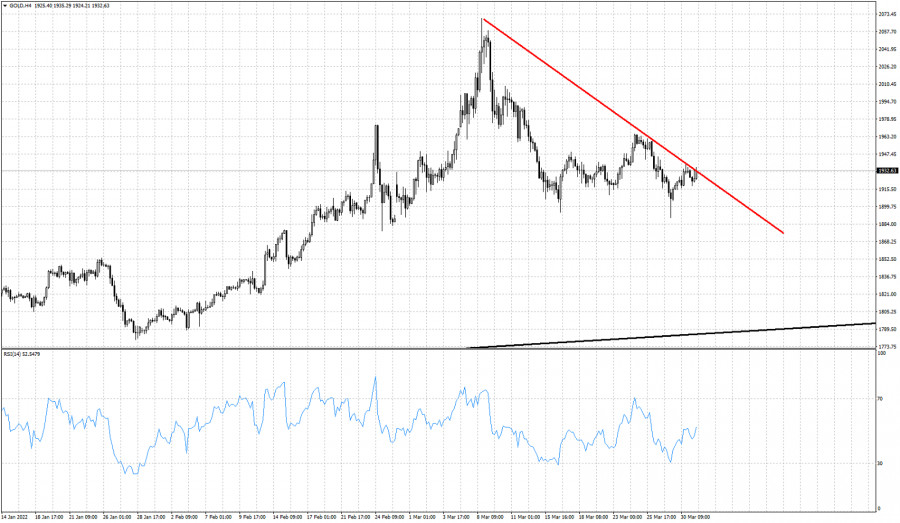

Gold price is trading at $1,932. Price is still below the red downward sloping resistance trend line, so we do not have a reversal to the upside yet. Support remains key at $1,900 where we saw bulls step in a absorb selling pressures.

Red line -short-term resistance

Gold price is challenging the red resistance trend line. Next resistance and target is at $1,967 if we see a break above $1,935 and the red trend line.A rejection here would bring Gold price back towards $1,900. So it is important for traders to be patient and wait and see how price reacts near the red trend line resistance.

Trading analysis offered by RobotFX and Flex EA.

Source #RobotFX Team

Comments

Post a Comment