The USD/JPY pair is dropping at the time of writing as the USD is punished by the DXY drop while the Yen is boosted by the Japanese Yen Futures growth. The pair is trading at 115.53 level at the time of writing.

The currency pair is making a strong rally today, but it remains to see if it will stabilize above the broken resistance area. Fundamentally, the USD received a helping hand from the US economic data. As you already know, the Revised UoM Consumer Sentiment increased unexpectedly from 61.7 points to 62.8, Core PCE Price Index came in line with expectations, while the Durable Goods Orders and the Core Durable Goods Orders reported better than expected data. Also, Personal Spending and Personal Income beat expectations which could be good for the USD.

USD/JPY Leg higher!

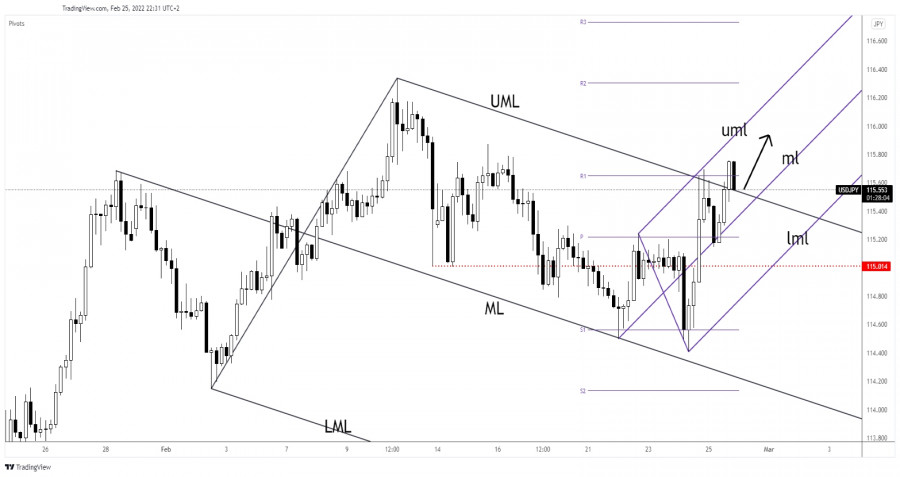

As you can see on the h4 chart, the USD/JPY pair rallied after registering only a false breakdown through the confluence area formed at the intersection between the weekly pivot point of 115.21 with the median line (ml) of the ascending pitchfork. In the short term, it has retreated a little to test and retest the immediate downside obstacles before jumping higher.

The price has managed to jump above the descending pitchfork's upper median line (UML) which represents a dynamic resistance. It still represents an upside obstacle as the rate could invalidate the breakout.

In my opinion, staying above the UML may announce an upside continuation. The bias is bullish as long as it stays above the ascending pitchfork's median line (ml).

USD/JPY Prediction!

Validating its breakout above the upper median line (UML) may signal further growth within the ascending pitchfork's body. A new higher high, a bullish closure above 115.76 could bring new buying opportunities with a potential upside target at 116.33 higher high.

Invalidating its breakout through the UML may announce a new downwards movement.

Trading analysis offered by RobotFX and Flex EA.

Source #RobotFX Team

Comments

Post a Comment