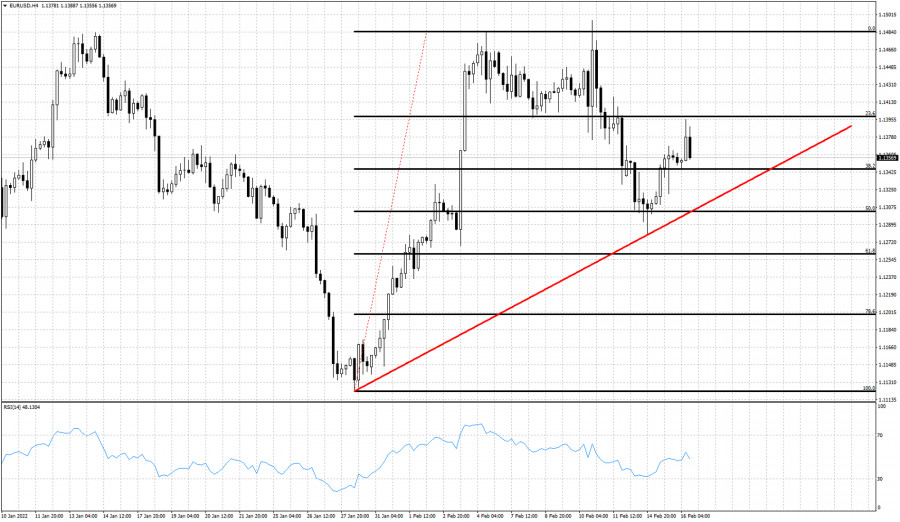

EURUSD has bounced off the 50% retracement and held above the key support at 1.13. Price has reached as high as 1.1395 earlier today but now it is at 1.1360. Price is vulnerable to a move towards 1.1310-1.1320 where we find the short-term upward sloping trend line.

Red line- support

Black lines -Fibonacci retracements

EURUSD is vulnerable to a move towards the red support trend line. As long as price is above this trend line, bulls will have the upper hand. EURUSD can continue higher if a higher low is formed after the current pull back. Forming higher highs and higher lows is needed in order for price to eventually break above the 1.1495 high towards 1.17. Forming a major higher low for a new upward move is a scenario that we talked about in previous posts and still very likely.

Trading analysis offered by Complex Trader - a RobotFX partner.

Source #RobotFX Team

Comments

Post a Comment