Apparently, the pound continued to be impressed yesterday by the results of the early parliamentary elections, and banally ignored basic macroeconomic statistics.

Nevertheless, if you look at this very statistics, the pound should have been reduced. After all, all indices of business activity showed a decline. In addition, it is still an extremely unpleasant call even if we are talking about preliminary data. Thus, the index of business activity in the services sector decreased from 49.3 to 49.0, while they expected growth to 49.8. Meanwhile, the manufacturing business activity index fell from 48.9 to 47.4, instead of growing to 49.5. As a result, the composite business activity index did not grow from 49.3 to 49.7, but decreased to 48.5. Therefore, the pound had clearly no reasons for optimism. So does British business.

Composite Business Activity Index (UK):

At the same time, it had a reason to decline, since preliminary data on business activity indices in the United States were clearly better than in the UK. In particular, the index of business activity in the services sector grew from 51.6 to 52.2, with a forecast of 52.0. However, the index of business activity in the manufacturing sector decreased from 52.6 to 52.5. Although this is still better than expected, since they expected a decrease to 52.2. As a result, the composite business activity index grew from 52.0 to 52.2. They just waited for growth to 52.3, but let the production index down. In any case, the data clearly indicate a decline in the pound, which did not happen yesterday.

Composite Business Activity Index (United States):

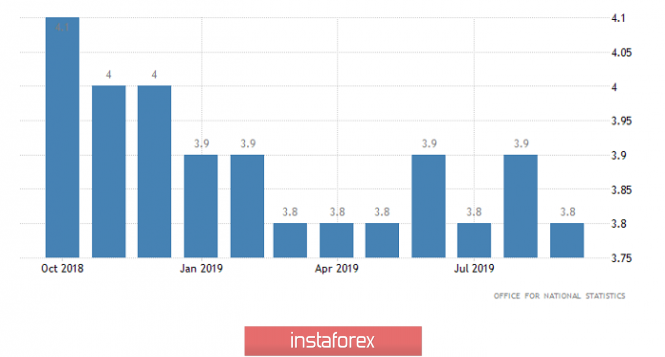

The pound began to become cheaper only today, apparently preparing for the upcoming data on the labor market, from a glance at the forecasts for which it is already becoming scary. Thus, the unemployment rate should increase from 3.8% to 3.9%, and the number of employees may decrease by another 10 thousand. Moreover, the number of employees decreased by 58 thousand in the previous month. The number of applications for unemployment benefits should be 29 thousand. In addition, the growth rate of the average wage, both taking into account bonuses and without them, should slow down from 3.6% to 3.4%. To simply put it, work should become less, and pay for it will also be less. As we can see, the picture is just amazing, and unsurprisingly, the pound is already going down. Thus, the confirmation of these forecasts will lead to further weakening of the pound. Nevertheless, there is a possibility that the pound will be able to resume its growth only if the data turn out to be significantly better than forecasts. But unfortunately, this is unlikely.

Unemployment Rate (UK):

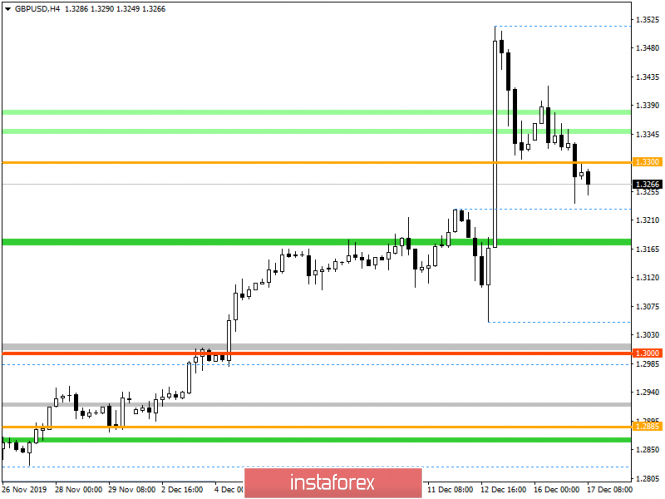

In terms of technical analysis, we see that the GBP / USD pair is rapidly recovering, relative to the momentum of the past days. At the moment, we managed to develop a little more than half of the candles on December 13, focusing below the level of 1.3300 and the downward interest does not end there. In fact, we see how the emotional background is decreasing, and everything is returning to its original course.

Considering the trading chart in general terms, we see that the upward movement locally threw us to the area of 1.3513, but failed to gain a foothold at these heights, thereby eventually having shadows and as a fact of return.

Thus, it is likely to assume that the downward interest will continue to persist in the market, where the quote is faced with the task of closing the impulse candle on December 13, focusing on the level of 1.3180.

Concretizing all of the above into trading signals:

- Long positions are considered in case of price fixing at higher than 1.3300.

- Short positions are considered in case of price fixing at lower than 1.3225.

From the point of view of a comprehensive indicator analysis, we see that indicators, relative to the hour and minute intervals, develop to decrease. In turn, the daily period still retains upward interest, against the backdrop of the recent rally.

via Hot forecast for GBP/USD on 12/17/2019 and trading recommendation

Comments

Post a Comment