EUR/USD: plan for the European session on August 30. Do not expect the euro to sharply fall below the level of 1.1028 on

To open long positions on EURUSD you need:

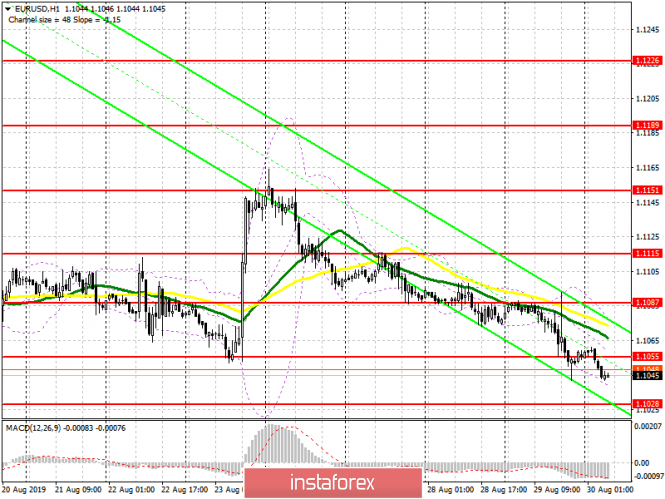

Buyers continue to stand aside and monitor how the euro is declining amid weak reports on the German economy and the eurozone as a whole. Today in the morning, the focus will be on data on inflation in the eurozone and the unemployment rate. A reduction in consumer price growth will hit the euro, but the decline will not be protracted, as major players will begin to take profits at the end of the month. Therefore, I am waiting for the support update of 1.1028 and when forming a false breakdown there, I recommend opening long positions. Otherwise, you can buy for a rebound from a low of 1.0990. The main task of the bulls will be to return to the resistance of 1.1055, consolidating on which will lead to the formation of a rising wave with the update of the resistance of 1.1087, where I recommend taking profits.

To open short positions on EURUSD you need:

Bears got to monthly lows yesterday and updated them. While trading is below the resistance of 1.1055, the market remains on the side of euro sellers. However, all emphasis today will be placed on reports on the eurozone. The next formation of a false breakdown in the resistance area of 1.1055 will be a signal to sell the euro in order to update the low of 1.1028, where I recommend taking profits. A further target of sellers will be support at 1.0990. With a growth scenario above the level of 1.1055 in the morning, which can happen after the good data on inflation in the eurozone is released, it is best to count on short positions in EUR/USD on a rebound from a resistance of 1.1087, or after updating a larger high of 1.1115.

Signals of indicators:

Moving averages

Trade below 30 and 50 moving averages, indicating a return of the dominance of euro sellers in the market.

Bollinger bands

If the euro rises in the morning, the upward correction may be stopped by the upper boundary of the indicator in the region of 1.1075.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20

via EUR/USD: plan for the European session on August 30. Do not expect the euro to sharply fall below the level of 1.1028 on

Comments

Post a Comment